[Tutorial] Submitting a Tax Exemption Certificate

CustomCat is legally required to collect sales tax on goods purchased in certain US states unless documentation is submitted indicating our transactions with your business are exempt from taxation. Below, you will find a step-by-step guide for using our Tax Wizard to submit the 2 most common types of exemption certificates: Resale Exemption Certificates & Marketplace Facilitator Exemption Affidavits.

For more information about the types of business that may qualify for tax exemption, states in which CustomCat will charge sales tax, & more, please visit our Tax FAQ page. Please consult a tax professional for advice on your particular tax situation.

How to Submit a Tax Exemption Certificate

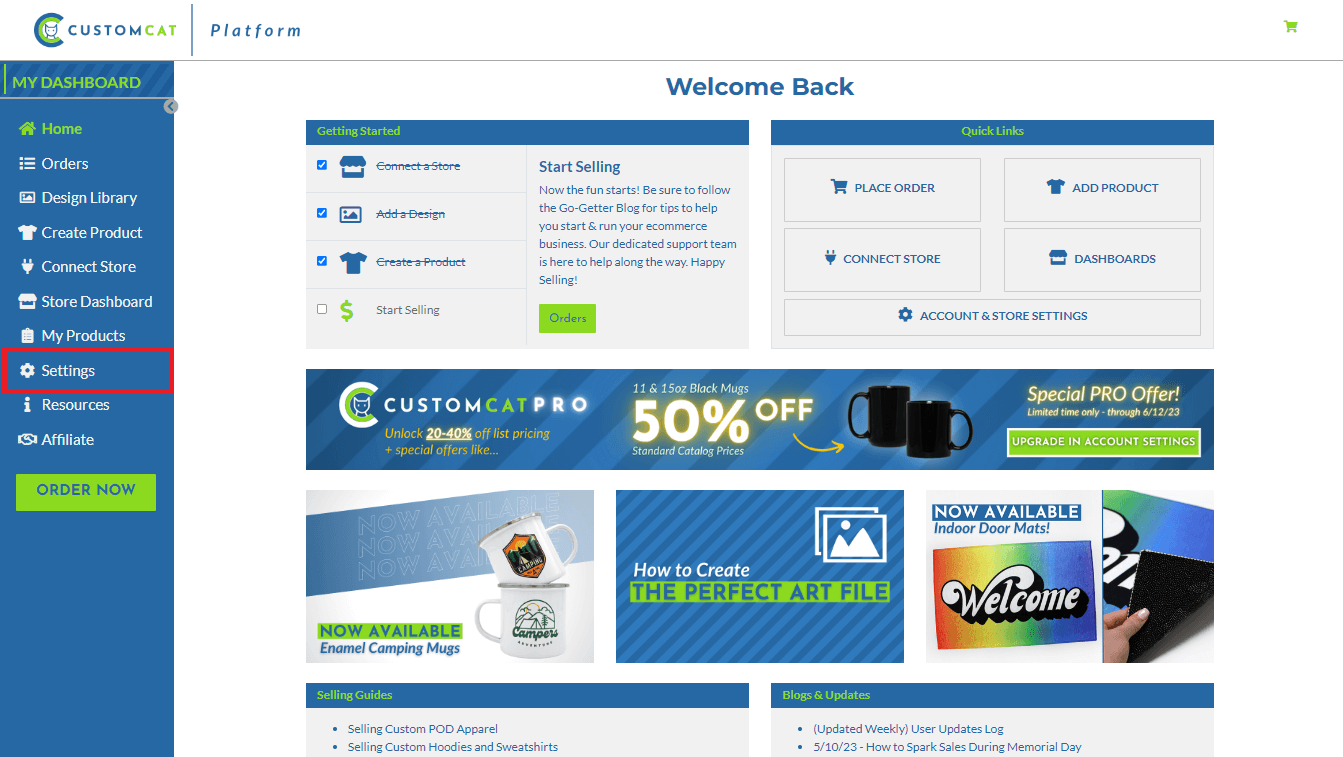

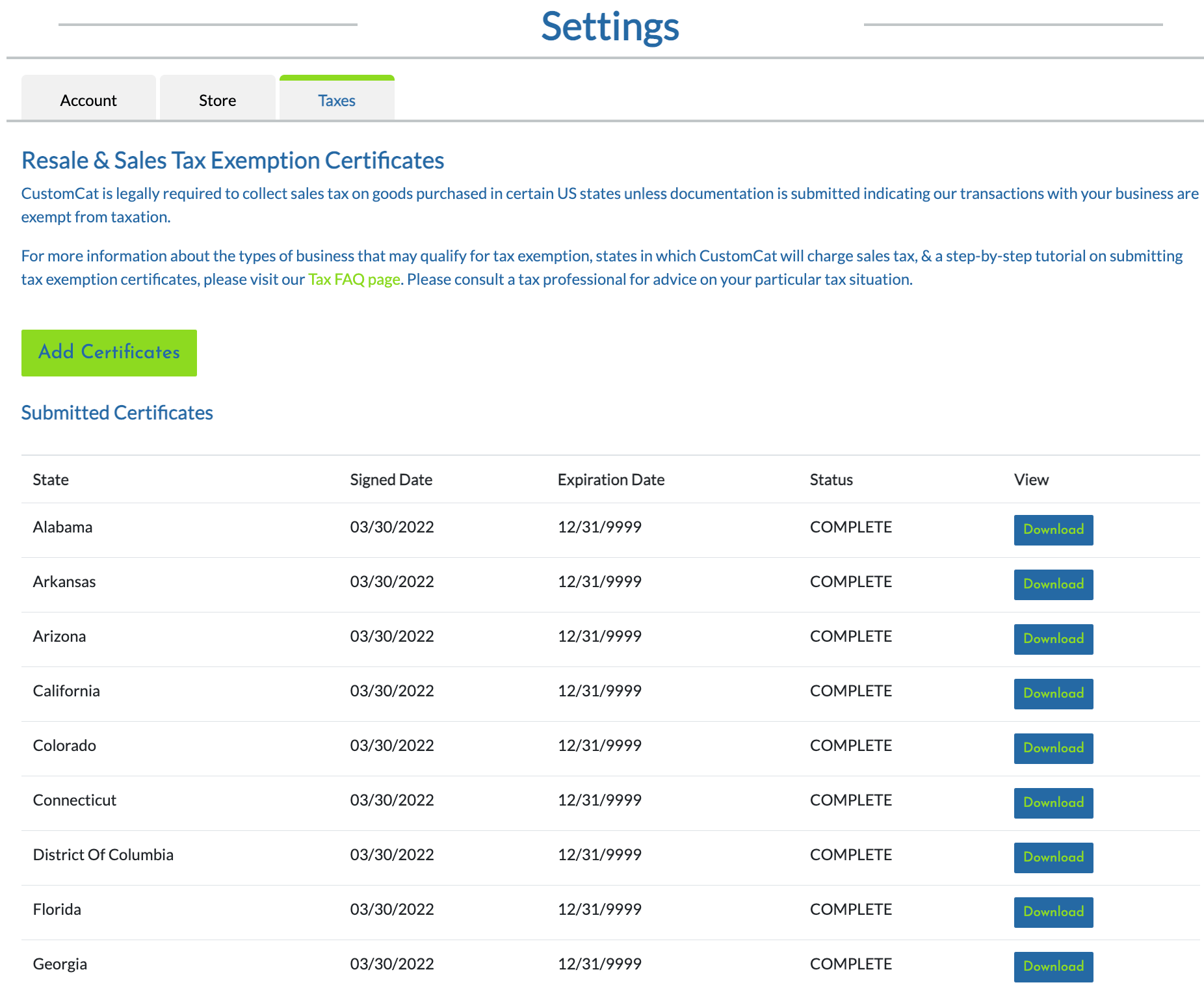

To submit a Tax Exemption Certificate, click “Settings” in the left navigation menu.

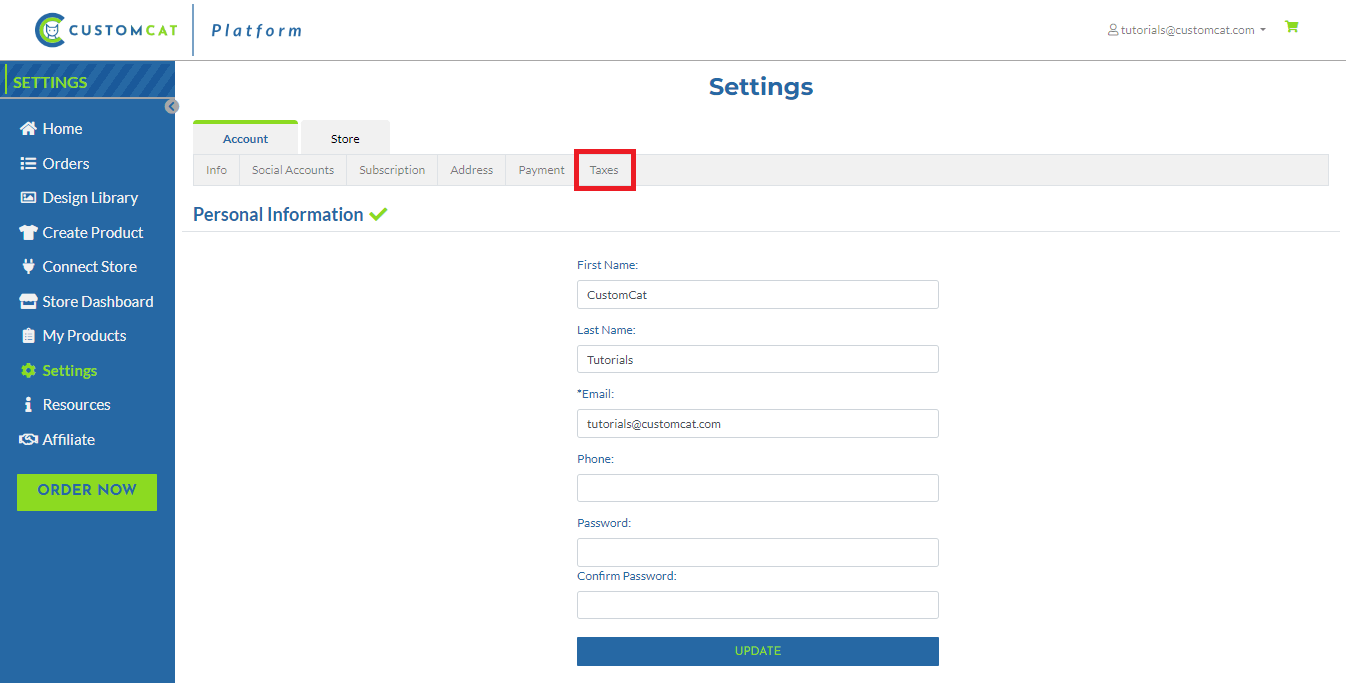

Next, select the “Taxes” tab to enter your tax-specific settings.

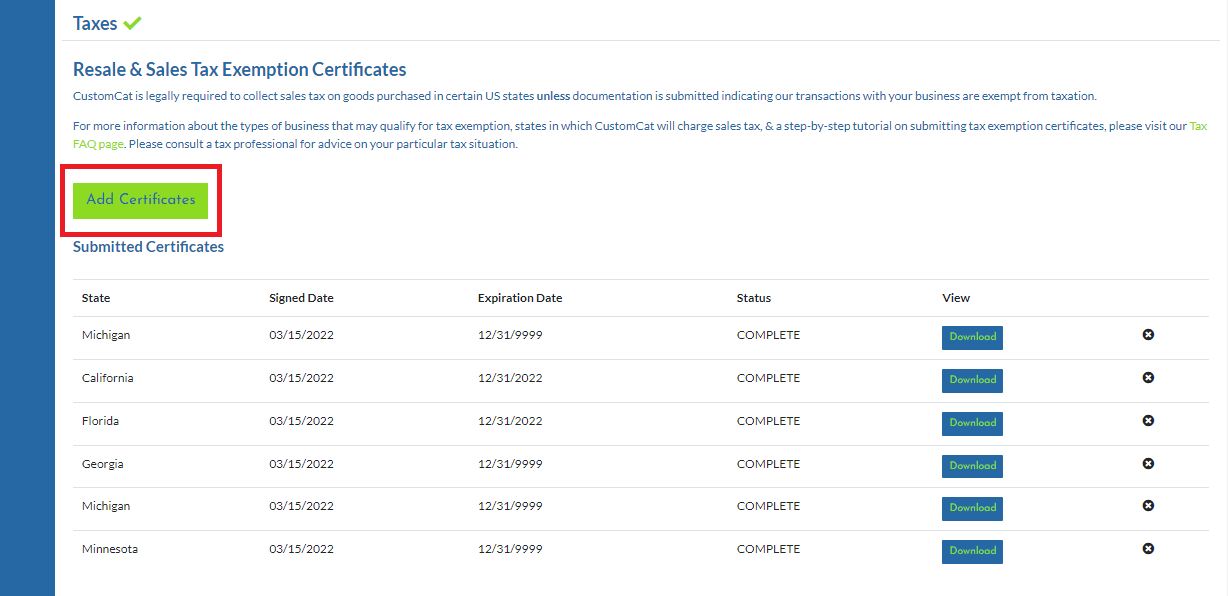

Once you’ve navigated to your Tax Settings, click “Add Certificate” to enter our certificate wizard.

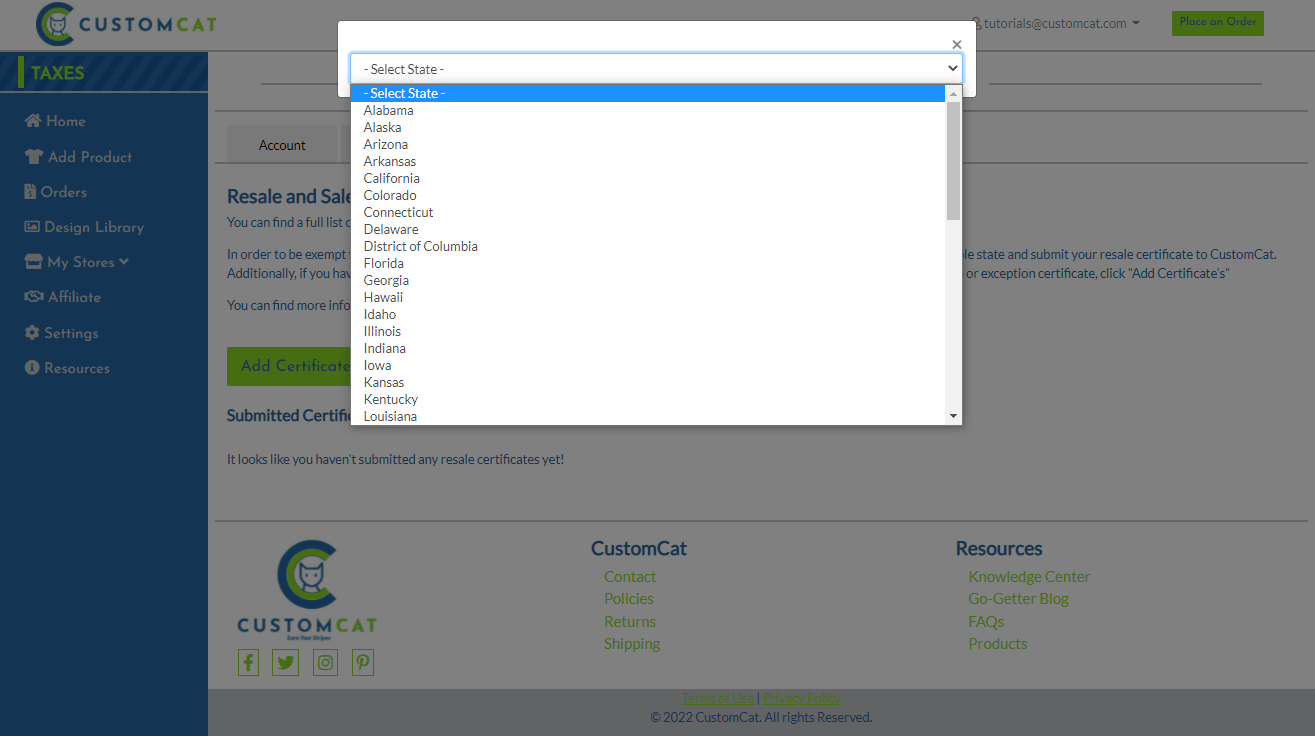

Next, select the state in which you’d like to submit documentation of your exemption. If you are submitting a Marketplace Facilitator Exemption, please select your home state unless your state does not charge a sales tax or you are based internationally. If your business is operated from a state that does not charge sales tax or you are based internationally, please select any state in order to be brought to the Marketplace Facilitator Exemption form.

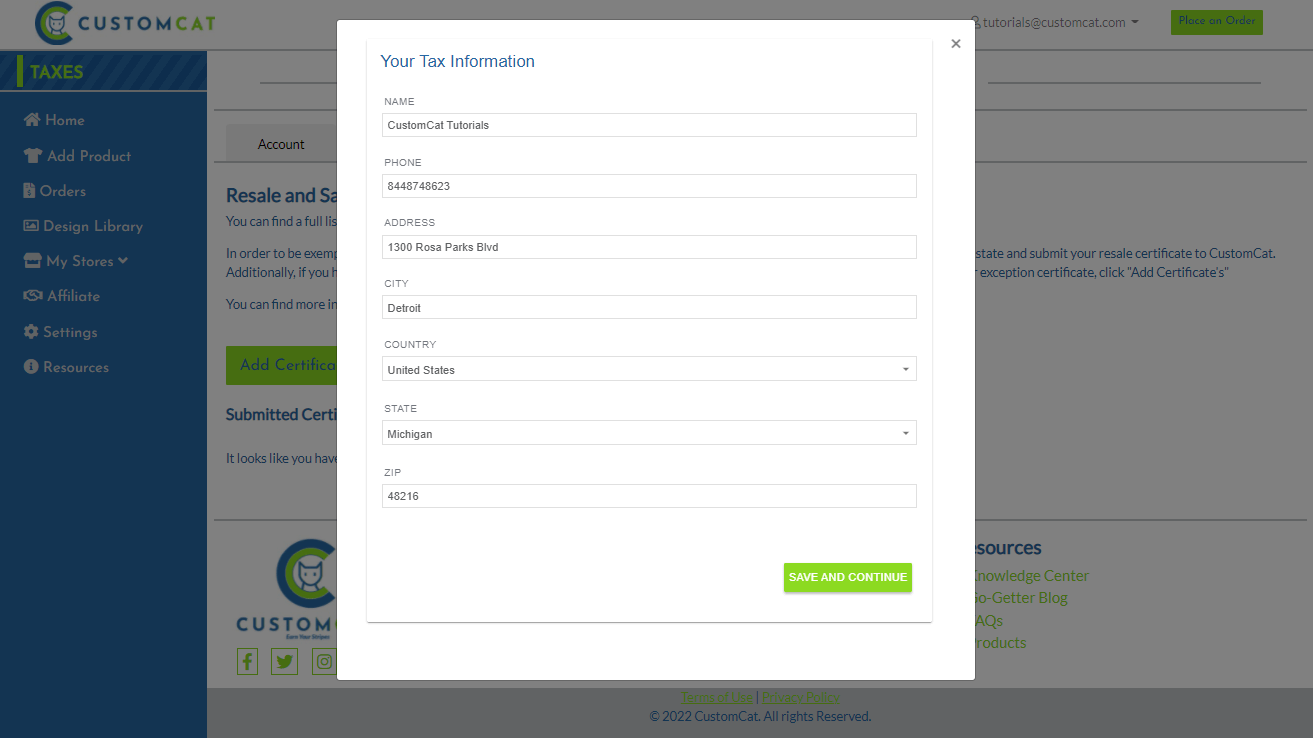

Enter your business name, phone number, & address as it appears on legal documentation related to your business.

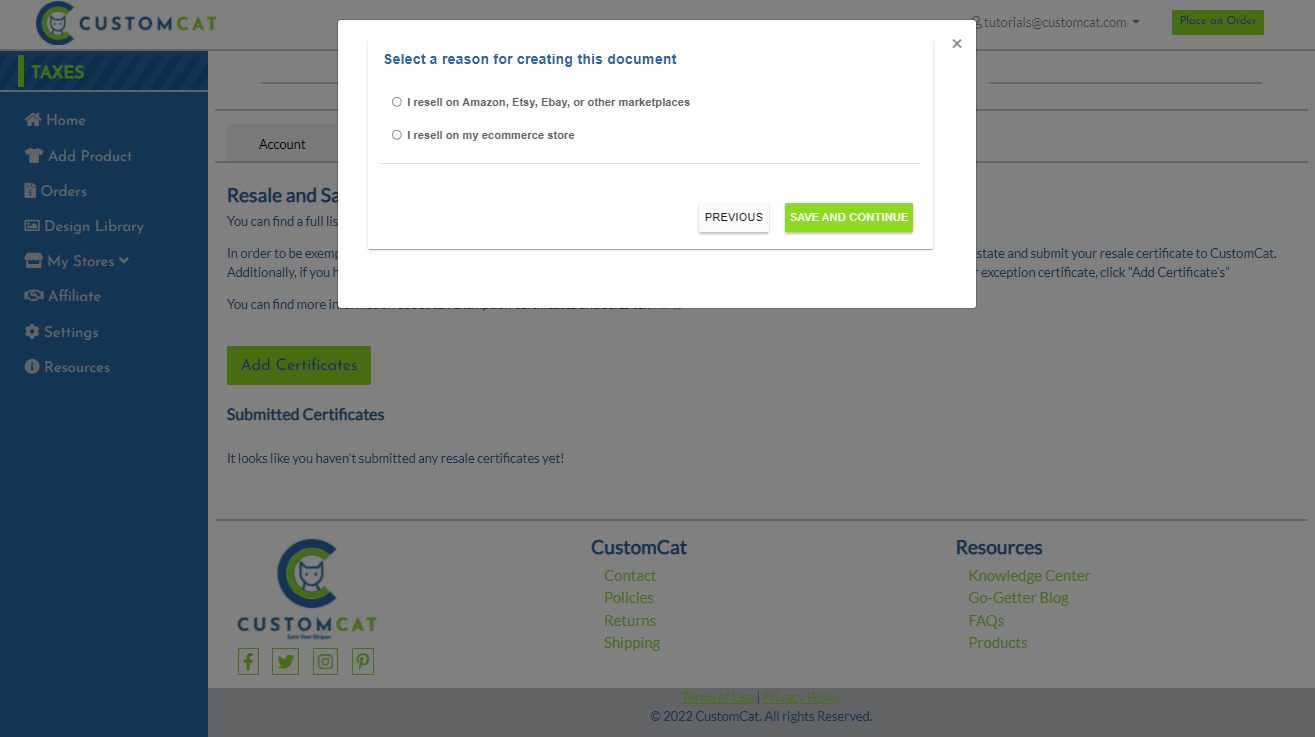

Next, you’ll select the reason you’re submitting this certificate, as our wizard will contour the module to the form that is appropriate for your situation.

If You Resell on a Marketplace (such as Amazon, Etsy, eBay, etc.)

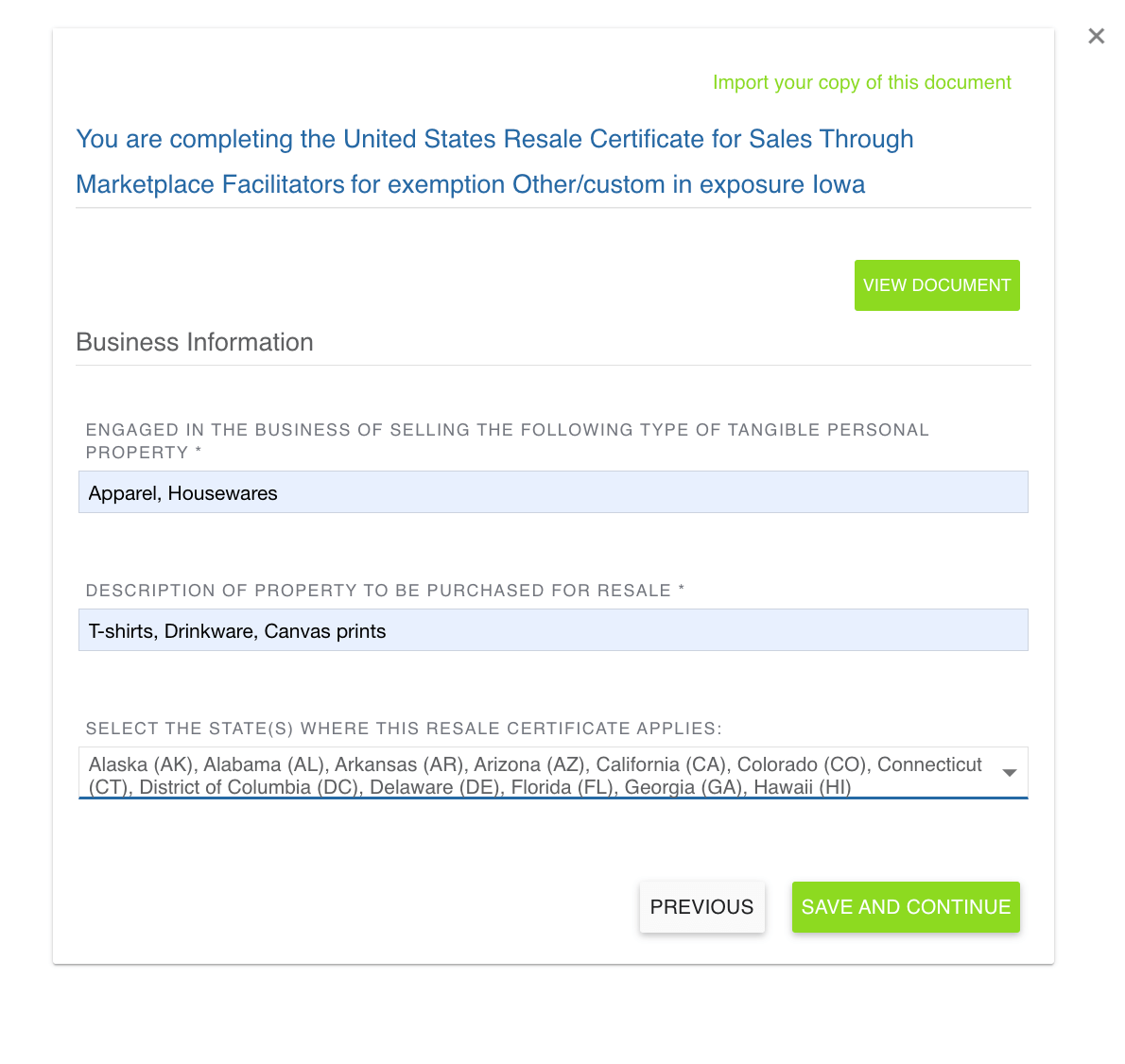

Enter both the general category of items you resell as well as a short descriptions of the items you resell. Additionally, you should select any state to which you may sell your goods from the dropdown menu. Your documentation will apply to any state you select.

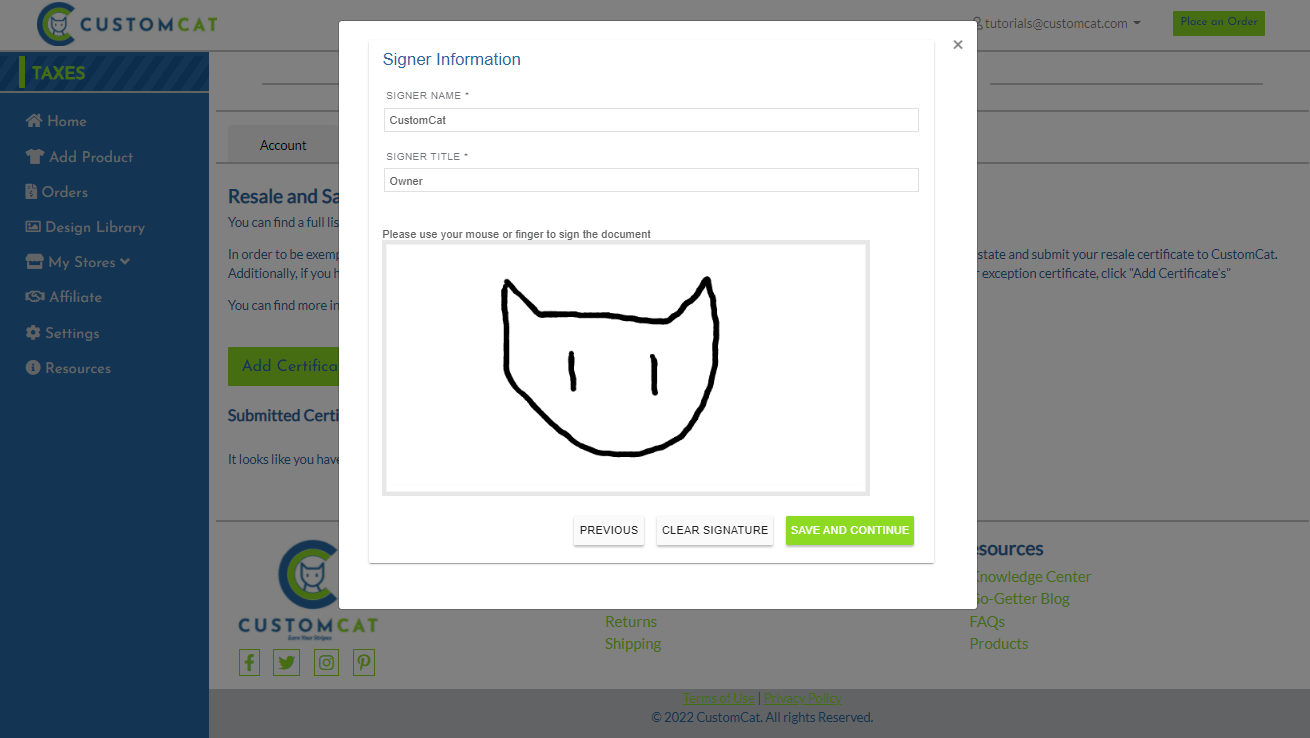

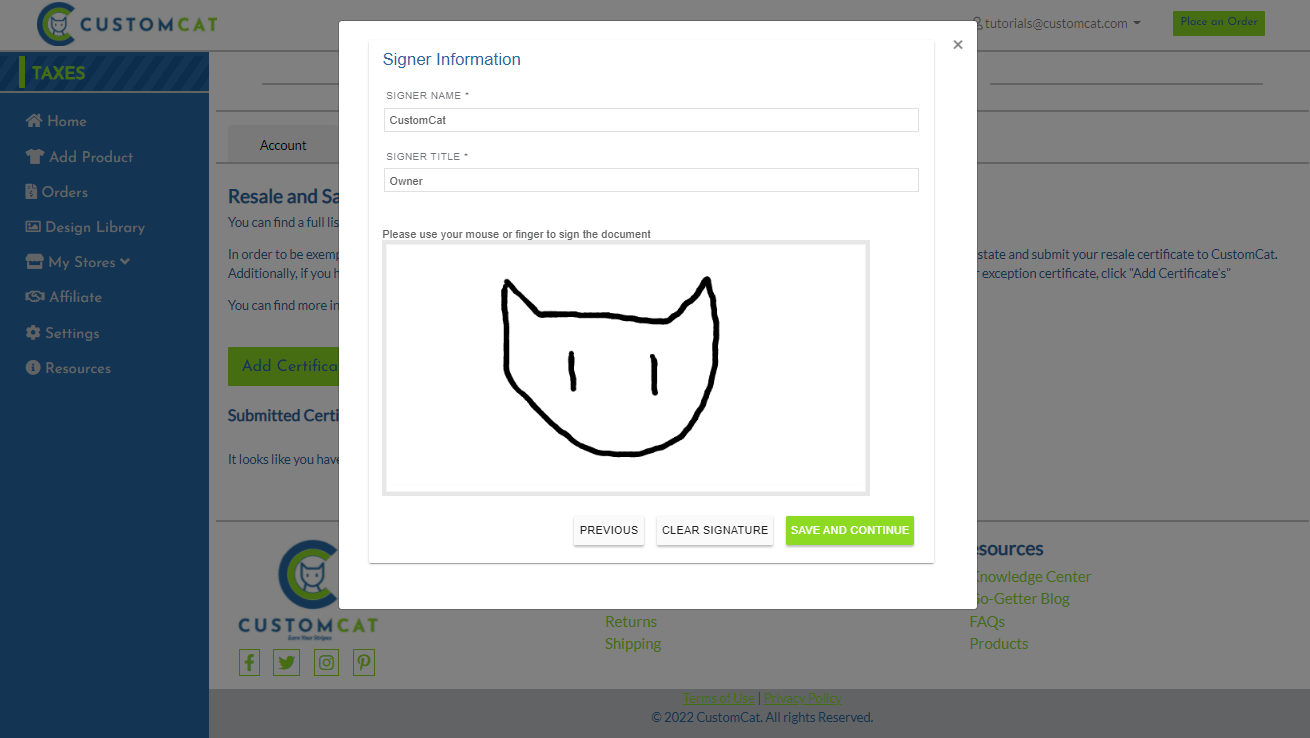

Lastly, enter your name & title, then add your signature before clicking “Save & Continue.”

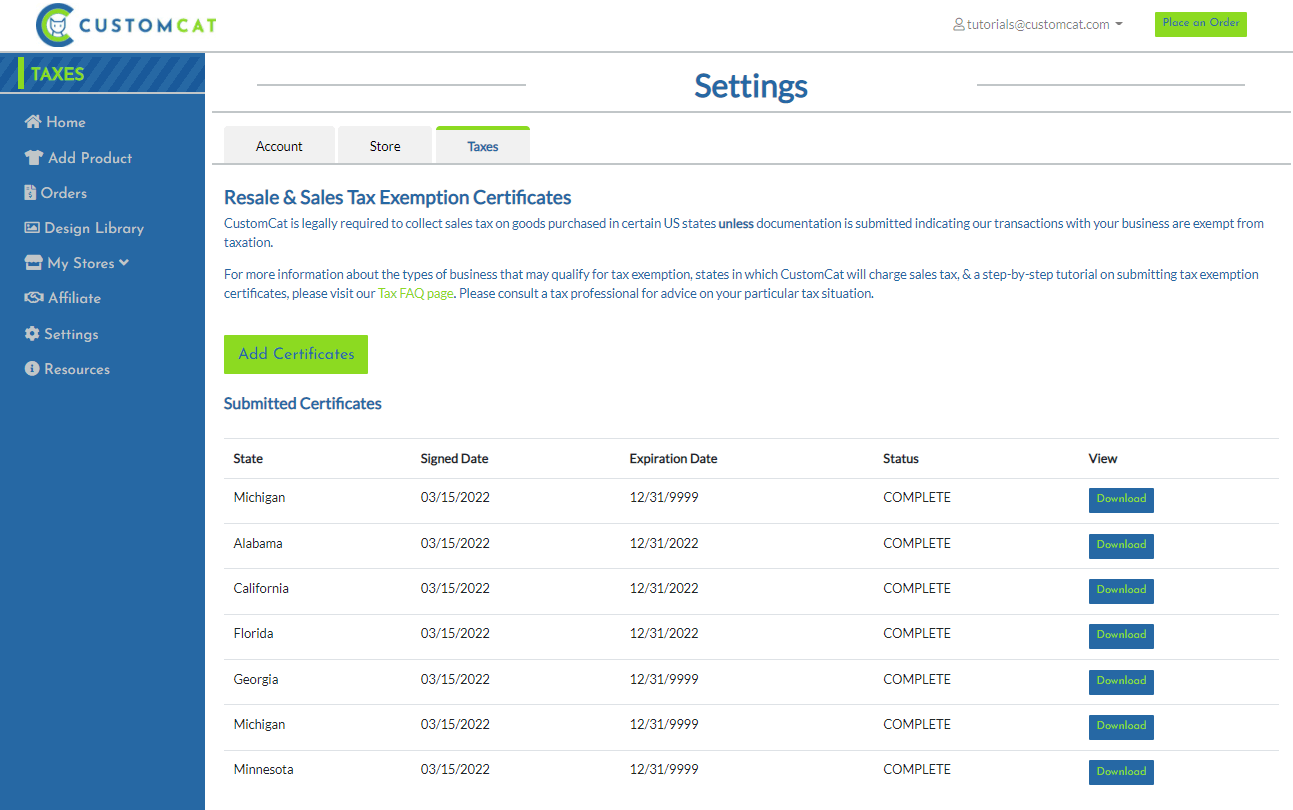

That’s it — you’ve successfully submitted a Marketplace Facilitator Exemption for the states you selected! You will no longer be charged sales tax in those states. Please note that you can download a pdf file of that form from your CustomCat Tax settings at any time. Additionally, the expiration date will be noted — in most states, this certificate does not expire.

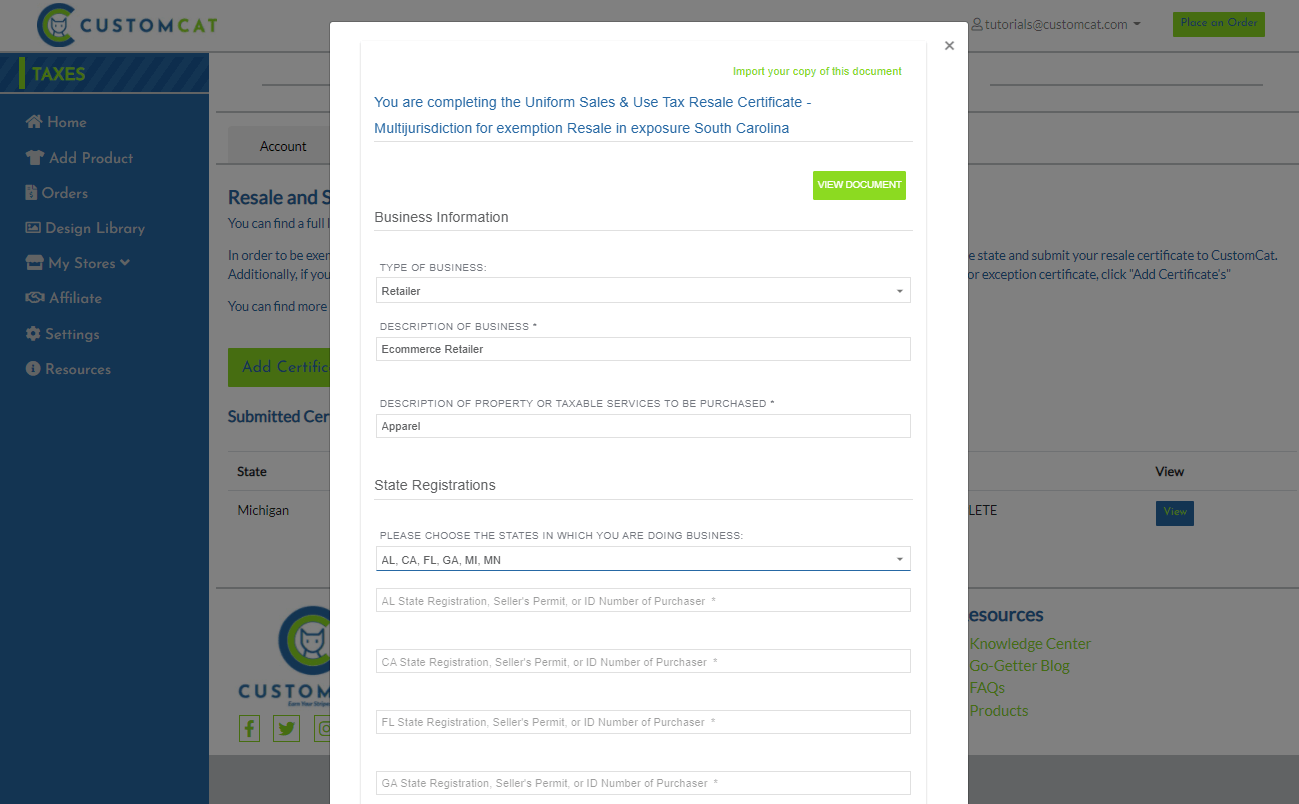

If you Resell in Your E-Commerce Store

Enter your business type, a description of your business, & a description of the goods you plan to resell. If you’ve selected a state that utilizes a shared exemption certificate form with other states, you can select other states in which you have an applicable state sales tax identification number & submit the certificates concurrently.

Lastly, enter your name & title, then add your signature before clicking “Save & Continue.”

That’s it — you’ve successfully submitted a Resale Exemption for the state(s) you selected! You will no longer be charged sales tax in that state. Please note that you can download a pdf file of that form from your CustomCat Tax settings at any time. Additionally, the expiration date will be noted — in the event that your certificate in a particular state expires, we will begin charging sales tax in that state, so please take note of expiration dates.

If you have any questions about the process of submitting exemption certificates or experience any issues with our platform when trying to do so, please reach out to our support team at [email protected]. Please note that we are not tax professionals & questions relating to your particular tax situation should be directed toward tax professionals familiar with your business.